By Elizabeth Frick | STC Fellow

I have a T-shirt that says, “English major, you do the math.” Ironically, as an English major who owns a small technical communication business, I have to use some numbers every day to ensure that my business and professional decisions are rational rather than emotional (left brain vs. right brain).

My other T-shirt says, “Got questions?” Together, these messages summarize my natural avoidance of numbers and questions—factors that affect research. In this article, I will share how I have overcome that reluctance and am now better able to perform the kinds of research that all businesses must conduct, starting with technology and tools that will help us in our businesses. Next, I will look at how to research and implement a business strategy, and I’ll also explore marketing research that helps self-employed technical communicators like me find new clients. Finally, I’ll explain some research that I do that helps me set my prices.

Researching Technology and Tool Purchases for Small Businesses

In terms of doing research in the field, let’s start with technology, not because I love it (I don’t), but because no business can survive without it. The most obvious technology purchase is a computer and relevant mobile devices. When it’s time to make hardware decisions, I need to ask a lot of questions:

- Should I stay with my trusted brand? Or should I spend the energy required to compare my current brand to others so that I can be certain that I’m choosing the current best products on the market?

- Should I upgrade dramatically or settle for fewer, less powerful features? Will the new, powerful features in a radical upgrade provide a return on investment (ROI) or just be fun to play with?

- Will I even be able to figure out the new technology? Will I have to hire someone to help me explore and use the features that I choose?

These questions are all key because sometimes, I make snap decisions when I’m in a panic (my computer just died) or I’m just being lazy.

Concurrently, I do a fair amount of research online and use simple spreadsheets to compare packages (bytes and bits and service packages) before I buy. To make a final decision, I then combine my findings with the advice of fellow colleagues and my IT guy. This kind of activity is relatively simple.

Other technology decisions may be more complex, especially when they intersect with financial decisions. For example, researching the ROI for high-speed Internet requires that I ask questions about two financial specifics:

- Before upgrading to a blazing speed, I must ask, “How much is each hour of my time worth?” This requires asking what my net profit is by accounting for how much time I spend both generating income and running the business.

- Then I have to figure out how much time the mega-fast Internet connection would theoretically save me—is it worth it? The good news is that I can build a dynamic spreadsheet for this data that I can easily update to keep financial numbers top of mind. When my Internet provider tries to upsell me to a faster package every time I call, I can quickly compute if the faster speed will net an increase in income or just help that megacompany’s bottom line.

A third type of research-related technology decision involves the software and apps that businesses choose to use. As a corporate trainer and editor, I don’t need the software applications that my writing colleagues use, so I can’t comment on that research strategy and its relevant questions. However, I imagine it might be similar to the strategy I followed ten years ago to research and choose my first webinar tool:

- First, I searched online for available tools and captured relevant details in a spreadsheet.

- Then I tried a 30-day free trial for a webinar tool that met my stated requirements within my budget. I asked, “Can I see myself using this software for a year?” When the answer was “Yes,” I signed up for a year.

- When my subscription expired, I documented my irritations with that webinar tool (it no longer exists) and repeated steps 1 and 2 above. I eventually chose the “GoTo” products that Citrix® offers, starting with the lowest level (GoToMeeting®) in 2007. After mastering the technology at that level, I progressed through GoToWebinar® and on to GoToTraining®, where I have worked happily for the last nine years.

Ongoing research involved watching Citrix’s webinars that demonstrate their features and upgrades so that I could continue to use more of my webinar tool; there’s always a lot of technical evolution to learn with any application or software. Occasionally, I’ll look at competing vendors to see if they have other options that I might want to consider as a reason for switching platforms. However, there’s usually a steep learning curve built into this technology, so my tendency toward inertia prompts me to stay where I am, no matter how alluring the competition may look.

In summary, this strategic approach to technology decisions seems to work for me:

- I read up on what I can.

- I use a trial subscription before purchasing (always!)

- I purchase and stick with whichever version seems to work best for me.

I imagine this is similar to the research path that larger organizations may follow, but they probably have more people on their research team than I do. I should also note that I am not an early adopter; once I eventually do choose a technology, I tend to stay loyal longer than most others, perhaps because I must do all the research myself and pay for the new technology.

Strategic Business Research

For my business, I offer at least three service lines, each connected to research processes and practices in some way. I started my company, The Text Doctor LLC, in 1990 offering writing, editing, and training services. Back then (and still today), I preferred training because I loved it and it paid the best. However, at certain points over my past 26 years in business, I have reacted to market conditions in the following ways:

- In the recessions that I have survived (1990-1991, 2001, 2007-2009), I edited and wrote but did not train much because training is one of the first cost centers to be cut in an economic downturn.

- Whenever I could, I trained and edited because I prefer those services over writing.

- Whenever I could, I was almost exclusively a trainer.

This reactive stance may have been strategic, although I am not at my core a strategic person. The success of this approach, however, is connected directly to effective research.

For example, in my early years in business, I figured out that the key to success was doing research to identify resources to help me strategize my service lines as a small business. In doing such work, I have used advice from experts at my town’s Small Business Development Center (SBDC) to help me think more like a business. The good news is that there are 900 SBDCs in the country (see https://www.sba.gov/offices/headquarters/osbdc/resources/11409), and here’s how they are advertised: “As a result of the no cost, extensive, one-on-one, long-term professional business advising, low-cost training and other specialized services SBDC clients receive, the program remains one of the nation’s largest small business assistance programs in the federal government.”

Through the help of my SBDC counselors, I learned to think of my company as a business and market accordingly, rather than consider that I was an artisan or academic. I guess I subconsciously thought that a business offered products—silly me. It took me awhile to shift my view, but the resulting research implications were huge. When I had thought of myself as an artisan or academic who writes, edits, and trains, I expected that other businesses would seek out my services. When I finally realized that I was a business offering service lines rather than products, of course I had to write a business plan (with the help of the SBDC). For more information about writing business plans, see my 2004 Intercom column, “Business Plans Build Good Business.”

Marketing Research for Small Businesses

Like so many other business activities, marketing—particularly for one who owns her own business—is a research-centric activity. For my own business, I’ve approached this process over time in the following way: After I wrote my business plan, I generated a marketing plan, using Jay Conrad Levinson’s “guerrilla marketing” concept to create a seven-sentence marketing plan. I learned to define, among other things, my target audience and my niche in the market. This led me to ask strategic questions such as:

- What kinds of companies in what kinds of industries might need my services?

- Are there specific businesses that might hire a small business like me?

- What size businesses are most likely to hire me directly rather than go through a contract house?

Answering these questions provided search parameters that I could use to access my local library database (which offers a mountain of databases, eBooks, and eMagazines). I use referenceUSA® online (their home page says they offer “Accurate Data on 44M Businesses”). This goldmine of research information has fueled many a marketing campaign for me. For more information about marketing plans, see my 2004 Intercom column, “Building a Marketing Plan.”

Using Numbers to Understand and Set My Prices

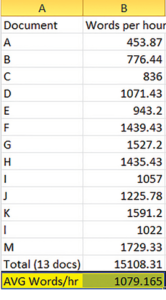

I have learned to use research to track my editing metrics to be able to answer the question: What is my average speed for editing certain types of documents? Once I know the answer to that question, I can estimate realistically and submit a bid on a variety of documents that will be fair to both me and the client, or I can reject a project based on a client’s unrealistic expectations.Figure 1 shows an example of what this research process often looks like.

I compile my bids in two steps: I do a one-hour edit on a client’s sample document, and I then compare those metrics to my overall numbers for similar documents. This helped me last summer, when a publisher contacted me and sent a sample document for me to do a trial edit. She said, “From the samples I have seen [in this project], I think your job will be a fairly simple, light copyedit.” (Don’t clients always say that?) She had projected that I could edit at 2666 words per hour. My trial speed was 1593 words per hour, almost 50% more than my average rate of 1000 words per hour but almost half of her expectations. Granted, I might have realized some economy when I became more familiar with the content, but our numbers were just too far apart.

If I had accepted the contract, I might have been tempted to compromise my quality of work to meet the deadline and expectations for time spent. The choice was clear: I politely declined the project. If I had followed my emotions—I wanted the project—I might have earned $18 an hour. (Minimum wage in my town is $15 an hour.) I was glad to have numbers to soothe my disappointment about turning down the job.

Who knew that numbers could be an English teacher’s best friend? Of course, writers and coders and other businesses must maintain similar metrics so that they are able to bid profitably.

Final Thoughts About Research

My success in business has depended on many factors, but the most important has been my ability to do research that focuses on improving the quality of my decision making. The key is knowing how to answer key questions associated with owning and operating a business.

Answering questions like these have helped me make better decisions:

- Whom do I know who has experienced this particular business problem and could help me?

- Do I really need high-speed Internet? Is it worth the cost? Or do I just want it for watching Netflix?

- Are there industries that I should research to find potential clients?

- Which of my service lines brings me the most joy? Can I afford to focus on delivering that service in the present economy, or do I need to widen my service lines?

- Should I buy X software (I really, really want it!)? Will it provide enough ROI?

- Do I want to lower my hourly rate and compromise my editing quality just because I “need” the income this month?

Good questions lead to good numbers and, eventually, to good business decisions. And good research is key to knowing what questions to ask and to finding the related answers.

ELIZABETH (BETTE) FRICK (efrick@textdoctor.com), The Text Doctor LLC, is a Fellow of STC. She has repurposed her “Business Matters” Intercom columns to her book, Business Matters, published in 2013 by XML Press. Her most recent book, Webinar School, also published by XML Press, was released in October 2016.