doi: https://doi.org/10.55177/tc321987

By Meghalee Das and Jason Tham

ABSTRACT

Purpose: What can technical communicators learn from a seemingly swank event such as the Reddit Wall Street Bets and GameStop (WSB-GME) saga? In this article, we identify tactical organizing in online spaces as a complex convergence of social uptake and socialized information afforded by news sharing and mass user interactions in digital platforms.

Methods: We employed a case study methodology that combined positivist and interpretive perspectives toward a developing event. We curated a series of Reddit posts pertaining to the WSB-GME saga and applied critical discourse analysis with a focus on the tactical and multimodal elements in these posts to identify their professional and theoretical implications.

Results: We found the networked social mania to be driven by a discourse founded on a common goal and a shared leadership that emerges from vertical and horizontal community building. While technology assumes an agentive role in facilitating tactical efforts, it can also create an information bubble, where users may be gripped by a cult-like devotion for their heroes and desire to be part of the latest trends, thereby making risky financial bets.

Conclusion: The WSB-GME saga illustrated implications for tactical technical communication as well as the impact of networked interactions on democratization of information, consumer engagement, and the rhetoric of finance.

KEYWORDS: Reddit, GameStop, social media, stock market, tactical technical communication

Practitioner’s Takeaway

- Understand the power of social media in grassroots organizing and facilitating tactical efforts.

- Learn how information is socialized by means of technical exchanges and political expressions.

- Identify emerging trends of retail investors embracing their collective power afforded by social media platforms.

- Recognize how networked interactions influence the democratization of information, consumer engagement, and the rhetoric of finance.

INTRODUCTION

In a networked society, social media have often been used as tools to facilitate communication, collaboration, organizing, and advocacy. When the US, as much as the rest of the world, struggled in the grip of the COVID-19 pandemic, a group of retail investors banded together on a Reddit forum called Wall Street Bets (WSB) to take on a system that they felt disproportionately benefited large corporations and institutional investors. In a classic David versus Goliath move, small investors used the networking technologies afforded by social media to collectively buy and hold the stock of video game company, GameStop (GME), which hedge funds had bet against. This mass act, fueled by Reddit posts from investors like Keith Gill, made the GME stock price shoot up 1,700% in January 2021, leading to massive gains for retail investors, with three of its largest individual shareholders gaining $3 billion, and hedge funds losing nearly $20 billion during that period (Griffith, 2021; Li, 2021).

In spite of the emergence of community, gratitude, and activism in the WSB subreddit, many Redditors also faced losses when the GME stock price fell. Yet, they continued to buy the stock because of an almost cult-like following prevalent in WSB. The purpose of this article is to study how the confluence of technology, digital rhetoric, remote collaboration, tied with an underlying idea of social justice, created one of the most remarkable events in the stock market in recent times. By analyzing the WSB posts, we identify key themes that can help technical communicators understand how a social media platform like Reddit can be used for tactical organizing, and what positive or negative real-world impact can the events emerging out of the WSB-GME frenzy have on tactical technical communication.

BACKGROUND

On March 11, 2020, when COVID-19 was declared a pandemic by the World Health Organization (WHO, 2020), stock markets around the world crashed spectacularly, with US indices falling 20% since February’s high, officially entering a bear market (Stocks Plunge, With Dow in Bear Market, 2020). Some of the biggest corporations, and institutional investors like banks, hedge funds, mutual funds, etc., witnessed record losses, and deliberated on the events with business pundits on mainstream media. Social media users on Reddit, Twitter, and TikTok, who engage in lively discourse on cryptocurrency, and meme stocks or stocks that rally due to social media hype (Nann, 2019; McCluskey, 2021), also responded to the financial crisis by sharing posts, memes, and hashtags like #StockMarketCrash2020, #BearMarket, #Recession, etc. Amid this financial mayhem, two inconspicuous players—American video game store, GameStop (GME), and a subreddit channel, r/wallstreetbets (WSB)—were seemingly unaffected by the events. GameStop saw its share price drop by only 9 cents to $4.14 on March 11, 2020 (Yahoo Finance, 2022), and the Reddit forum, which had less than a million subscribers that week (Metrics for Reddit, 2021), mostly engaged in whimsical banter on gold prices, getting their hands on falling airline stocks, and quips on the political response to COVID-19.

However, less than a year later, the subreddit would be involved in a remarkable networked participation of small investors taking on institutional investors of Wall Street, partially fueled by outrage against the government’s delay in passing the COVID-19 stimulus bill and measures which small investors felt mostly benefited big players as people struggled with job losses (Hadly, 2021). We discuss these sentiments in more detail in the Results section, which includes screenshots of posts by WSB members. Using the networking technologies and organizing tactics afforded by social media, day traders on WSB and financial analyst Keith Gill, who has several alter egos like u/DeepFuckingValue (DFV) on Reddit and The Roaring Kitty on YouTube and Twitter, shared information with subscribers about how GME was undervalued, and big hedge funds and short sellers had placed bets on the stock price to go down. Gill and other Redditors on WSB encouraged followers to buy the heavily shorted GME stocks en masse, which would drive the price up, forcing the short sellers to buy back GME shares at a higher price to cover their losing bids, and consequently, keep pushing the price astronomically high––what some commentaries called a short squeeze.

While the stock price of GME increased slightly in early January 2021 after Chewy co-founder Ryan Cohen, who has extensive digital sales experience, was added to the GME board of directors, the stock skyrocketed to $347.51 on January 27, 2021, leading to a whopping 1,700% increase from its January 1 price due to the coordinated strike by Redditors (Phillips & Lorenz, 2021). The collective engagement of retail investors on social platforms like Reddit and trading apps like Robinhood led to a tactical rebellion against the higher powers of the financial world, and small investors made huge profits.

However, the very participatory nature of social media that drew attention of the public and helped mobilize the masses to tactically organize attacks against short sellers then led millions of people to join the subreddit, and share partial responsibility for the fall in GME stock prices. WSB subscribers rose exponentially in January 2021, much like the stock that fueled the whole saga, and the group had over 10 million users as of June 2021. In the hopes of gaming the system to get rich quickly, and motivated by news of investors becoming millionaires overnight, landing movie and book contracts, paying off student loans, buying houses, and donating millions in charity, users started buying the GME stock, even at unreasonably high prices. Social media discourse and the unique lingo, memes, and inside jokes used in the subreddit made users feel like they were part of a community, making a small contribution to collectively fight for a cause. According to a survey by Yahoo Finance and The Harris Poll, nearly 9% of Americans bought at least one share of GameStop in January 2021 (Wolff-Mann, 2021), and so did traders from all over the world, who traded GME and shared their support on social media platforms (Handagama, 2021).

At the height of this frenzy, traders were outraged when multiple platforms like Robinhood and TD Ameritrade restricted transactions for GME and a few other trending stocks, bringing down the price of the GME stock. A large number of new WSB members who had flocked to the subreddit were fairly new investors and started panic selling even at a loss. Just like members had posted screenshots of their gains earlier, which encouraged more people to invest in GME, now members started posting screenshots of their losses on the forum. Such was the frenzy around GME, that sharing losses, termed “loss porn,” did not dampen the enthusiasm surrounding this “stonk.” However, Robinhood’s decision to restrict trading continued for the next few days, pushing the stock price down to $53.50, and the issue came under the scrutiny of the U.S. Securities and Exchange Commission (SEC) and politicians, who demanded Congressional hearings on the role played by trading platforms, social media, and hedge funds in influencing investors. During the period of this study, the GME saga continued, as the stock was still popular in spite of being volatile, and the subreddit showed no sign of toning down its support for the stock.

LITERATURE REVIEW

While the WSB-GME mania was one of its kind, the notion of grassroots-organized efforts to affect impactful outcomes at the higher economic level is not new to a networked global society (e.g., Cummings, 2002; Dumitrica & Felt, 2020). To better understand the featured mania in this study, we borrow from theoretical lenses that scrutinize the rhetorics and tactics of collective action in a time when social media afford citizen-organized advocacy movements.

Technical communication scholars have regarded social networking technologies and information sharing as a tool to organize communities. Ridolfo and Hart-Davidson (2019) in their edited collection of essays go as far as seeing networked communication platforms and rhetorical uses of these platforms to be capable of inflicting war and conflict. Their arguments can be backed by national events that have garnered media and policymakers’ attention in the last two decades, most notably the Occupy movement and its subsequent iterations.

What began as the 2011 Occupy Wall Street protest in Lower Manhattan, New York City, had grown from Zuccotti Park to the whole nation and across borders of several other countries thanks to networked participation by individuals from around the world. “The group’s presence grew. . .grievances were heard in over 100 U.S. cities and 1,500 international cities,” researchers documented, as they paid attention to the role of social media in fanning the fire of this demonstrative movement (Forgey, 2015, p. 3). In an episode of This Rhetorical Life (2013, Mar 15), filmmaker Dennis Trainor Jr. contended that “the Occupy movement has never been about the right to occupy public space. It’s a tactic to draw attention to engage in dialogue” (n.p.). Jones (2014) identified this deliberative tactic as enabled by participatory culture and network culture (i.e., “#occupywallstreet”). Rice (2016) further speculated that, “With social media and the interactions it fosters, outrage becomes a digital aggregation” (n.p.). Rice’s notion of digital aggregation is understood as a type of digital response that “produce[s] the feeling or sentiment of outrage because of the aggregation created” (2016, n.p.).

Social media platforms present a fertile ground for activism causes and change-making activities. The ubiquity and exteriority of social media like Facebook, Twitter, and Reddit––akin to open-source applications––afford a “rhetorical ecology” that liberalizes views and actions (Truscello, 2005). As Tufekci (2013) pointed out, social media have become public platforms for networked activism due to high visibility and ease of engagement. Social networks allow users to create communities with activism goals. Lockett (2021) revealed that these digital communities can indeed affect public opinion. Case in point––Potts, Small, and Trice (2019) examined the user-generated topics and classifications on Reddit and how they can reify community values and conversations. They found that “influencers can shape a substantial percentage of the most popular conversations,” and thus it is of vital importance to know “what topics/values are important to a community and who the influencers within that community might be” (Potts et al., 2019, pp. 361–362).

In times of large-scale disasters or distress, social media have proven to offer a community-driven platform for vernacular crisis communication, updates, and responses (Potts, 2014). In the professional workplace, social media can aid the process of “inventive social coordination” (Pigg, 2014, p. 77) and support the symbolic-analytic work of technical communicators through “multigenre narratives” or storytelling (McNely, 2017). In instructional settings, social media have provided opportunities for learners to work with human and nonhuman components in the technical knowledge-making process (Getto, Franklin, & Ruszkiewicz, 2014). Most importantly, for the purpose of our study, social media afford public engagement through multimodal (Walls & Vie, 2017), political (Sano-Franchini, 2018), and discursive means (Shepherd, 2020).

Indeed, driven by social media channels and networked interactions, the Occupy movements are an exemplary case highlighting the use of networked technologies for tactical revolt against the powerful. More importantly, it opens a space to investigate the agentive nature of technologies in facilitating human agendas. Technical communication theorists have applied a “posthuman” perspective to understand how nonhuman technologies constitute a proactive role in communication, persuasion, and organization (cf. Mara & Hawk, 2009; Boyle, 2018). Posthumanism “rejects the idea that humans can be known, largely on the grounds that the dividing line between human and non-human or animal is difficult to delineate in the first place and highly permeable too” (Buchanan, 2010, n.p.). Hence, the posthuman perspective considers the thing-power of inanimate objects, including communication technologies, as capable of co-creating the social world. As the famous media theorist Marshall McLuhan has argued, the medium of any communication acts as the host that influences (or massages) the way a content is perceived. In the words of MacDonald (2011), “Media are not only tools and machines but also profoundly human artifacts…Media are the physical and metaphysical ‘extensions of man’ [channeling McLuhan, 1964]” (n.p.).

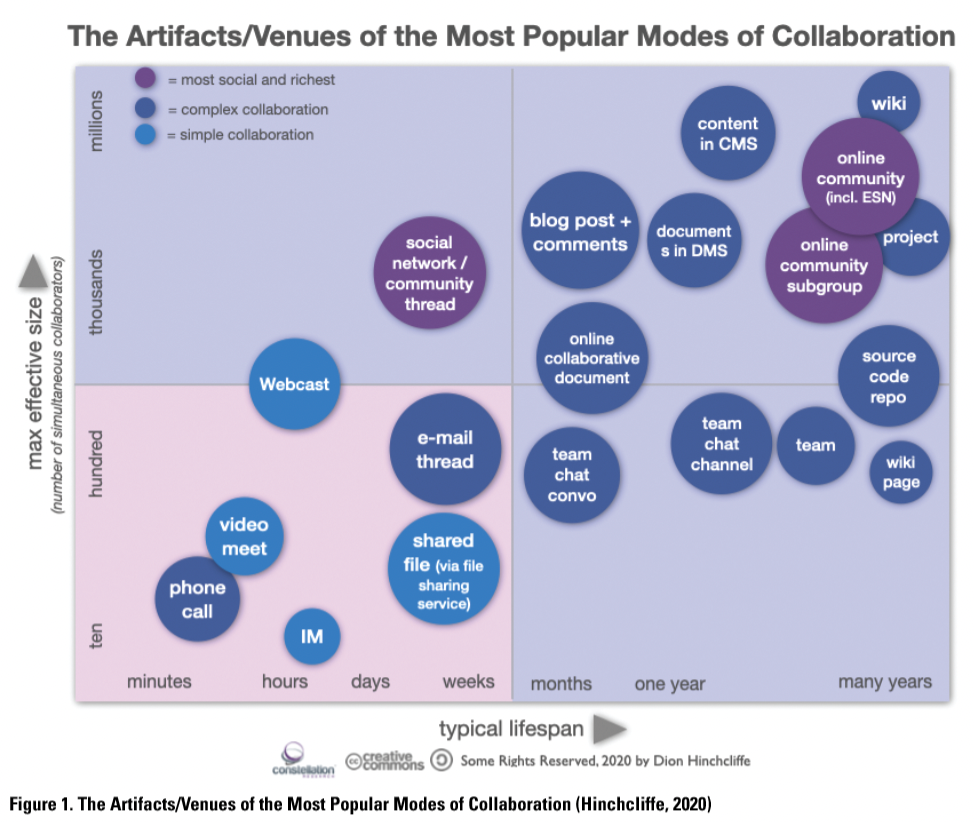

For technical communicators, the posthuman perspective situates media technologies as co-facilitators with human actors in tactical efforts. In their call for proposals to an edited collection, Sarat-St. Peter and Kimball (2020) noted that the concept of tactical technical communication has become increasingly accepted as a lens to examine the scope and identity of technical communicators. This condition broadens the organizational focus of technical communication (Kimball, 2006). Kimball’s notion of organization initially concentrates on institutional culture while examining the ways individuals “have appropriated technology to increase their freedom of agency and their involvement in shared cultural narratives about technology” (p. 68). A little over a decade later, Kimball (2017) expanded tactical technical communication to consider how user collaboration is done through “open forums where users can share information with each other” (p. 2). As networked technologies today encourage users to interact and co-create content, these technologies allow for localizing content and communication for specific needs with community strategy (Shivers-McNair & San Diego, 2017). Recent collaboration studies have confirmed that enterprise social networks (ESNs) remain the most popular and effective tools for simultaneous collaboration (Hinchcliffe, 2020) (Figure 1).

The close association of social media with citizen-activist movements have shown how technologies can be a tool for productive disruptions. The politics of confrontation can be seen as a tactical use of technology for advocating social justice. As Colton, Holmes, and Walwema (2017) put it, tactical technical communication suggests direct applications to social justice advocacy. Agboka (2012) revealed that social networks afford a participatory approach to social design that takes into account the local knowledge systems of the participants. Colton and Holmes (2016) agreed that participatory efforts can enact a more effective, “active equality” practice that fosters social justice. Technical communication scholar-advocates Jones, Moore, and Walton (2016) and Walton, Moore, and Jones (2019) have subsequently provided critical frameworks for building coalitions and combating inequities (i.e., challenging practitioners and scholars to apply inclusivity and intersectionality as ways to identify and eradicate oppressive effects that technical communication causes).

The close association of social media with citizen-activist movements have shown how technologies can be a tool for productive disruptions. The politics of confrontation can be seen as a tactical use of technology for advocating social justice. As Colton, Holmes, and Walwema (2017) put it, tactical technical communication suggests direct applications to social justice advocacy. Agboka (2012) revealed that social networks afford a participatory approach to social design that takes into account the local knowledge systems of the participants. Colton and Holmes (2016) agreed that participatory efforts can enact a more effective, “active equality” practice that fosters social justice. Technical communication scholar-advocates Jones, Moore, and Walton (2016) and Walton, Moore, and Jones (2019) have subsequently provided critical frameworks for building coalitions and combating inequities (i.e., challenging practitioners and scholars to apply inclusivity and intersectionality as ways to identify and eradicate oppressive effects that technical communication causes).

In this study, we apply a posthumanist networked perspective to investigate the role of social technologies and the tactics of grassroots organizing through the case of r/wallstreetbets and GameStop (WSB-GME) mania. This perspective is informed by the posthumanist view of technologies as we synthesized above, as well as the networked nature of communication as facilitated by social media. In other words, we view social media as a co-facilitator of the WSB-GME mania as we examine the human interactions that perpetuated the series of events. We ask, primarily, the following questions in attempts to understand the impact of this frenzy event (which continued to develop as we write) and the implications it serves for technical communication practices and theories.

- What can the WSB-GME online frenzy teach us about tactical organizing?

- What can the WSB-GME online social mania teach us about tactical technical communication?

To address these questions, we have devised a systematic approach to curating and analyzing Reddit postings that corresponded to key events during the peak of WSB-GME and specified those that garnered high engagement from users. We describe our methods in the next section.

METHODS

To examine the WSB-GME events, we employed a case study methodology synthesized by Rashid et al. (2019). A qualitative research approach that is commonly used in technical communication research, the case study methodology combines positivist and interpretive lenses “in exploration of a phenomenon within some particular context through various data sources” (Rashid et al., 2019, p. 2). Following case study expert Yin’s extensive body of scholarship (i.e., Yin, 2002, 2011, 2017), we applied the case study research protocol summarized by Rashid et al. (2019, p. 6):

- Describe the case

- Describe the people involved in the case

- Describe their relationships with each other

- Collect empirical materials

- Interpret/analyze collected materials

- Present conclusion

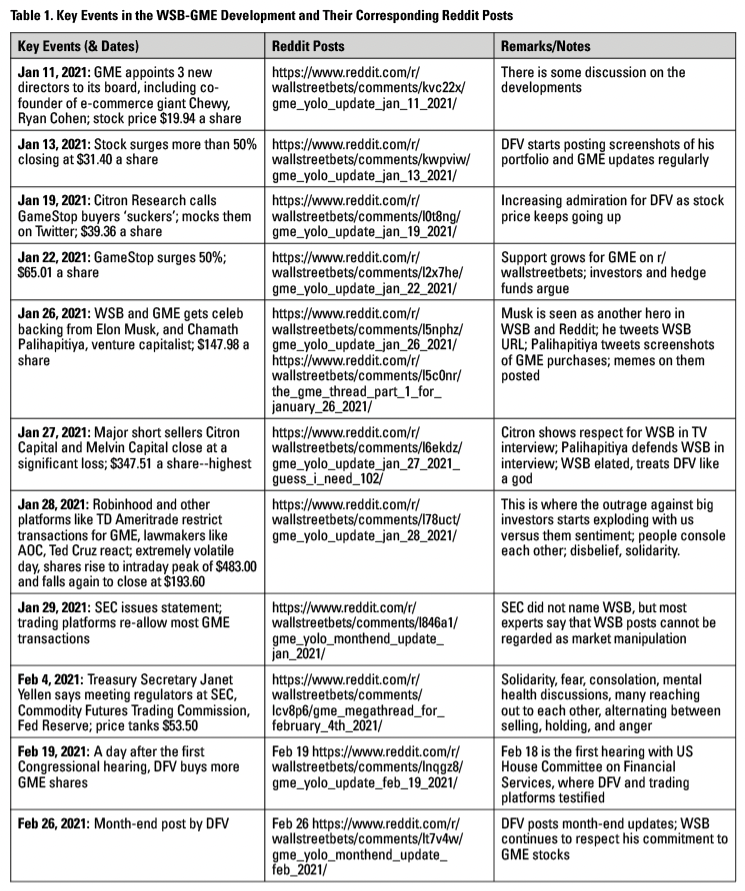

We conducted the first three steps of the protocol via the background section in this article as well as the key event descriptions in Table 1. Our empirical materials were Reddit posts curated from January and February 2021, a period we deemed most relevant and with highest user engagement related to the WSB-GME mania. High engagement is represented by content (posts) that garnered enough upvotes to appear and remain at the top of a thread on Reddit. We also considered the intensity of user interactions (comments, replies, etc.) in these posts as we selected our dataset. There were many relevant threads on the subreddit r/wallstreetbets, the most popular being those posted by Keith Gill or DFV. His “GME YOLO update” series contained screenshots and comments on his investment portfolio, and this was where the highest engagement happened in the early days of the GME mania. Since we selected URLs with the most popular posts and those which appeared on top in search archives, we analyzed only DFV’s Reddit posts on significant dates until January 22, 2021.

From January 26, 2021, the GME short squeeze started in full swing, and the WSB subreddit erupted with numerous multi-part discussion threads, including pre-market and post-market analysis by members. Also, instead of posting every day, DFV started giving updates less frequently, and so another popular discussion series emerged during that time called the “GME Megathread” created by other members of WSB. Therefore, we also selected URLs of the GME Megathread, in addition to DFV’s posts, with the highest number of upvotes on dates when major events related to this case happened.

Nevertheless, all these threads are part of the whole WSB-GME frenzy on Reddit and complement each other; they are connected thematically and in terms of the major players. The Reddit posts are included in the second column of Table 1 with remarks about the specific post or event in the third column.

To analyze the Reddit posts, we applied critical discourse analysis (CDA) with an eye toward the tactical and multimodal elements in these posts. According to Huckin, Andrus, and Clary-Lemon (2012), CDA provides “a repertoire of precise, context-sensitive tools that can assist researchers […] in interrogating power and ideology as they are indexed and produced in specific instances of public discourse” (p. 110). A multimodal emphasis guided our focus on not just textual expressions but also modalities such as visuals (icons, emojis, memes) and interactive components (user voting, reposting) that make up the overall meanings in a discourse. Together, CDA and multimodality are complementary to our case study methodology as they supplement the analysis protocol with considerations of “ways in which power is embedded and circulated in discourse” (Huckin et al., 2012, p. 112). In our case, the discourse is facilitated by social networks in a distributed manner. Our analysis followed these stages:

- Select the discourse (i.e., WSB-GME event)

- Locate the data sources/texts (Reddit threads and posts)

- Understand the background of the texts

- Code posts to identify overarching themes

- Analyze the social relations controlling or affecting the production of the texts

- Interpret the meanings of the major themes

The coding process was performed manually with both authors selecting the Reddit posts representative of key events in the WSB-GME development and writing independently, then together about the emergence of major themes. We stopped creating new themes when about 80% of the selected posts were categorized into the first four major themes. We then added a fifth category, miscellaneous, to cover posts that directly engage with the WSB-GME case but did not fit into the other themes. These miscellaneous posts were mainly memes, but they showed an interesting way of expression that added to the discourse around this case. We will discuss this discursive practice in the results section with more curated examples.

RESULTS

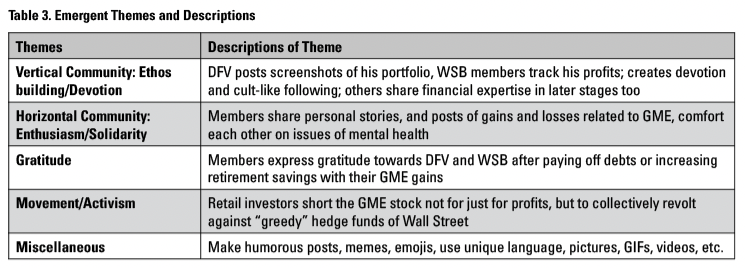

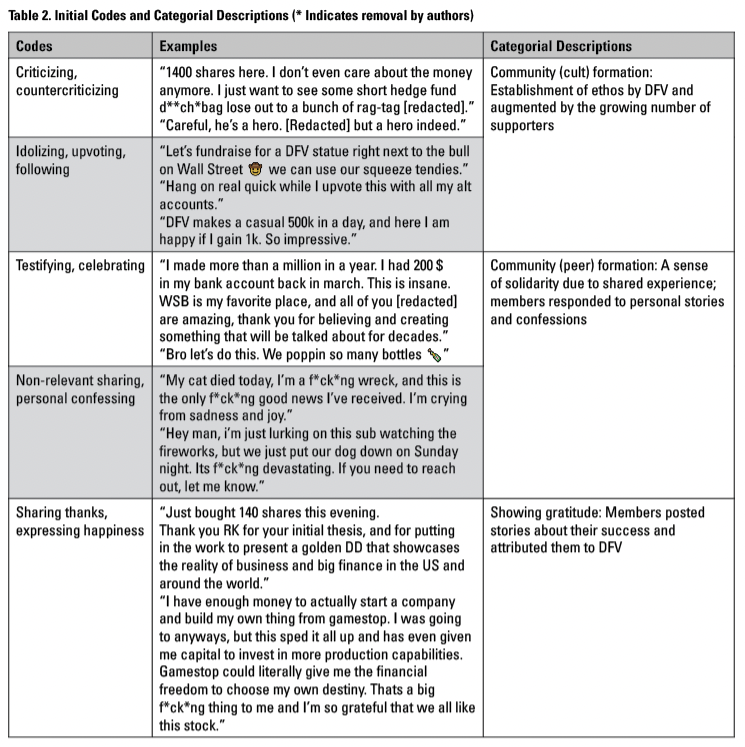

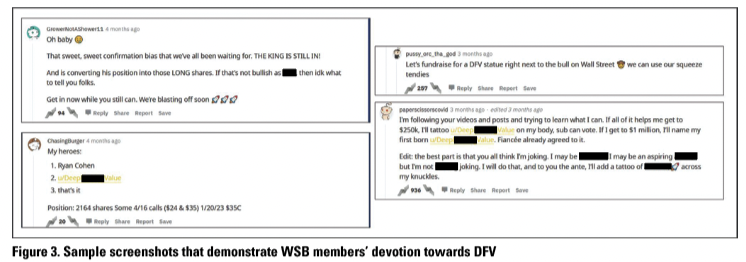

To emphasize the social relations in this case, we organized the analysis thematically based on the emergent roles of those who interacted with WSB-GME on Reddit (Tables 2 and 3). The primary players in the Reddit forum pertaining to the GME saga were influencers like DFV who gave daily updates about his GME stock purchase; perceived experts who wrote detailed posts explaining financial concepts and strategies, subreddit members (old and new) who followed the influencers and experts and amplified their posts through awards and upvotes; different groups of bots that spammed the threads and pumped the GME stock price up or down; and “memers” who posted photos, GIFs, and memes, and played a crucial role in community building through their unique, seemingly nonsensical, and sometimes offensive, ableist, and profanity-filled lingo.

Noticeably, in Table 2, ableist language was used by posters to degrade other users. The offensive r-word is often used in wallstreetbets and similar financial subreddits as an anagram for the word “trader,” as traders on such platforms take extremely risky investment decisions, supported by their call for YOLO (you only live once). Like many scholars and writers, we express concern about such offensive and ableist terminology and have redacted the term in our quotations and figures. While language policy is not explicit in Reddit’s community guidelines, some subreddit moderators have banned the use of offensive language, but not in the case of the wallstreetbets subreddit.

In Table 2, we included the codes and selected examples of postings that informed the development of subcategories. The emergent themes of these Reddit posts echoed the events of the real world and the corresponding emotions of the investors (Table 3). In the first few weeks, posts reflected a sense of ethos building by the influencers and community building by the members. Our analysis of the community sentiments led to the observation of vertical (influencer-follower) versus horizontal or peer-to-peer community building. As reflected in the screenshots included in this section, these sentiments were discernible in the tone of the postings. This was followed by elation and altruistic activities as the stock price reached its peak and people posted about their profits and donations to various organizations or persons in need. But as the price crashed, this exhilaration was replaced by denial, fear, and solidarity among members. Throughout all these phases, there were memes for all the moods, which encouraged people and provided levity to the discussion threads.

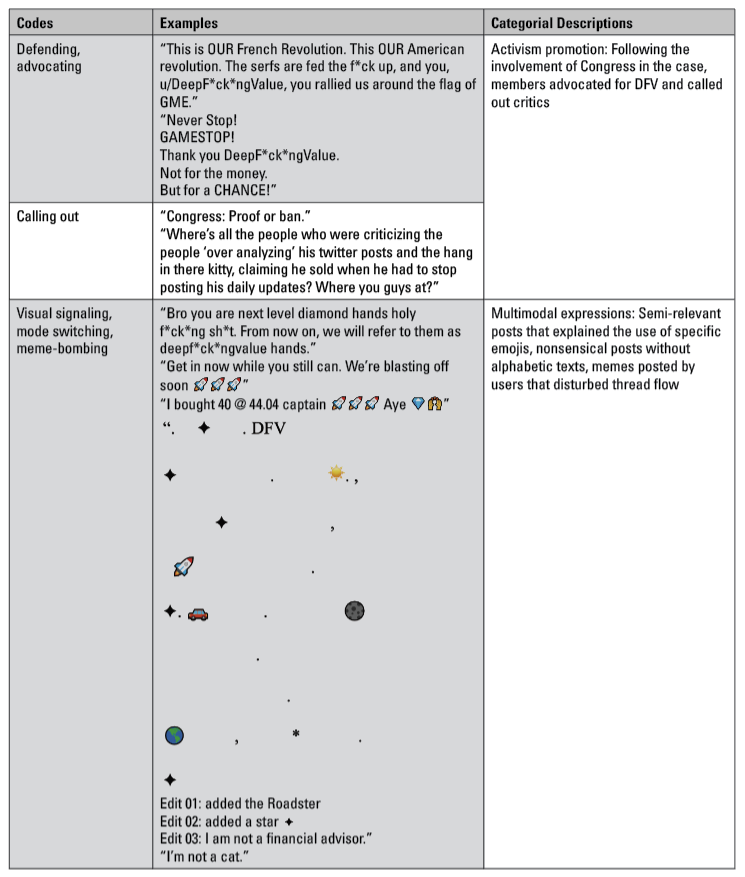

Vertical Community: Ethos Building/Devotion

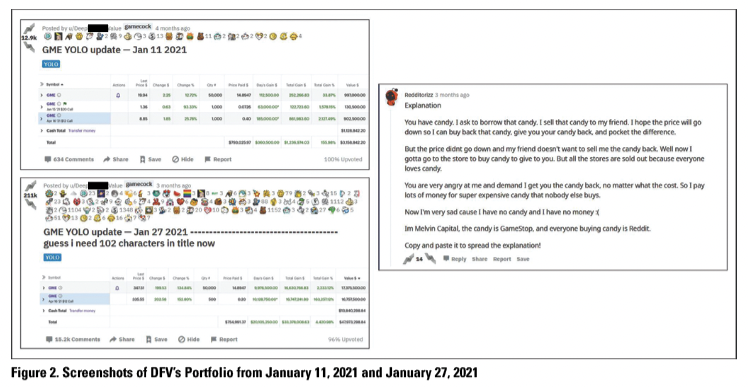

The primary driver of the GME frenzy was DFV, who shared daily screenshots of his portfolio to Reddit (Figure 2). When we started our analysis, most of the user engagement was taking place in DFV’s posts. As the popularity of this stock grew, more people chimed in with general information about the stock market as well as analysis conducted using machines and software not easily accessible to the average investor. In Figure 2, we showed how DFV’s total gains from GME was just over $1.2 million on January 11, 2021; as he posted screenshots of his portfolio every day, followers could see his gains go up. For example, when the GME stock reached its peak on January 27, 2021, DFV’s loyal followers who have been witnessing the performance of his portfolio for weeks, saw his total gains go up 4,421%, leading to comments on his portfolio like “All hail the king,” “our king,” and “Your [DFV’s] steady hand convinced many of us to not only buy, but hold. Your example has literally changed the lives of thousands of ordinary normal people.” This signified the power of data visualization and its impact on building the ethos of investors like DFV, as he did not post any text or comment, but let images of his portfolio boost his credibility. Even when DFV posted an image of his losses the next day, his followers reviewed the data in the portfolio and commented, “THE KING HAS SPOKEN HOLD,” “HIS CASH TOTAL DID.NOT.BUDGE. DFV TEACHES PATIENCE TO THE FRIGGIN DALAI LAMA.” We noticed a sense of vertical community emerging here, where DFV was not only seen as an expert, but also someone who cared about his followers by being transparent about his decisions. When the founder of WSB, Jaime Rogozinski, sold the rights to his book and his life story to director Brett Ratner and RatPac Entertainment for a movie (Vlessing, 2021) and actor Noah Centino was cast to play DFV in a movie by Netflix (Bentz, 2021), this led to increased legitimacy of the main players in the GME saga, which further fueled the stock price and people’s devotion towards DFV, in particular (Figure 3).

Such almost cult-like devotion towards online influencers is not new and has been seen in the case of other socio-cultural and political figures like 2020 presidential candidate Andrew Yang and his Yang Gang (Gage, 2019), tech celebrity Elon Musk (Stephen, 2018), as well as more harmful examples of cyberbullying and misogyny in the GamerGate controversy (Massanari, 2017), or conspiracy theories like The Storm and Pizzagate, rife on r/The_Donald, 4chan and 8chan (Martineau, 2017). While WSB members in the posts that we studied expressed devotion towards DFV by suggesting less ominous things like tattooing his name on their body, raising money for his statue on Wall Street, or keep investing in GME for as long as DFV believed in the company, such deification of an influencer left unmoderated could potentially take a negative turn too, such as people investing their life savings in an overvalued stock.

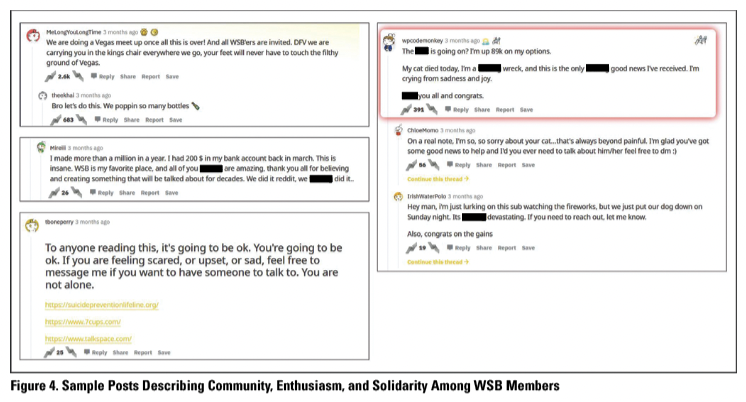

Horizontal Community: Enthusiasm/Solidarity

All social media platforms, by definition, have a social or community organizing goal, facilitated through groups, subreddits, pages, fundraising features, and communication options like comments, gifs, stickers, awards, etc. Subreddits are no different. They allow enthusiastic members to create a horizontal community to reach out to like-minded people for sharing common interests and tactical organizing, unrestricted by geographical boundaries. As the GME saga unfolded, WSB members found themselves deeply invested in the events associated with GME, and engaged with each other, displaying a wide spectrum of moods. While some made plans to meet in the real world to celebrate their earnings, others shared personal stories and expressed solidarity on events like pet deaths. There was a peer-to-peer or horizontal solidarity, as members comforted each other when the prices crashed. Mental health was a recurring topic, and in an anxiety-filled atmosphere like a volatile stock market, members offered hope to one another saying that these falling prices were only temporary (Figure 4).

Gratitude

At the peak of the GME saga, as WSB members began to make profits, there was an outpouring of gratitude towards DFV and the WSB community in general, who helped educate members about the stock market and this particular stock. Followers posted their gains as well as how they were using their earnings. Many had made gains on 100%–200% of their investment, or even more, earning thousands of dollars if not millions. WSB members shared how they paid off their debts or mortgage, saved for their children’s education, and increased their retirement savings. The sense of community was also another factor here, as members congratulated and expressed happiness for each other (Figure 5).

Movement/Activism

Movement/Activism

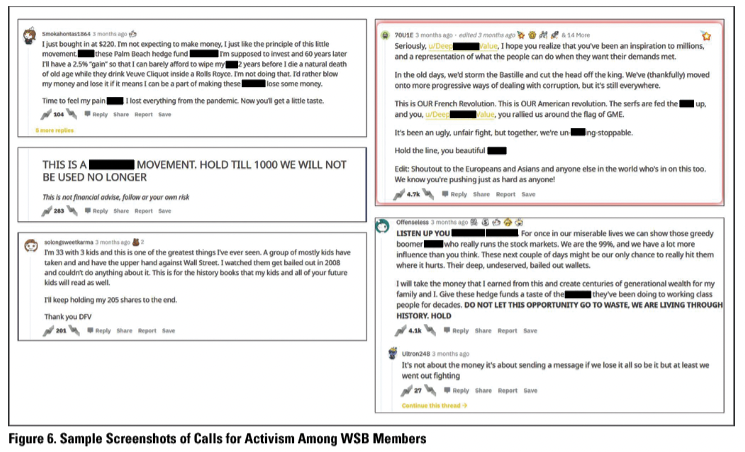

While the exponential rise of the GME stock price led to incredible gains for retail investors, these investors realized that the only way to short a stock was if they collectively held their respective stocks—not sell anything even when the price was 200%–300% high. This activity created a scarcity of supply, forcing hedge funds to buy back the shares at higher prices, thereby continuing a loop of indefinite price rise, or as Redditors would say, “going to the moon.” Social media platforms like Reddit facilitated this development by allowing investors to organize themselves, communicate with each other on a large scale, and unite for a cause. Some Redditors saw the GME saga as a revolution and a continuation of the Occupy Wall Street movement, but this time they were gaming the system to their own advantage. In Figure 6, we included screenshots of conversations happening on the WSB forum, with key excerpts such as:

- “Do not let this opportunity go to waste, we are living through history. Hold.”

- “It’s not about money it’s about sending a message if we lose it all so be it at least we went out fighting.”

- “This is OUR French Revolution. This is OUR American revolution.”

- “I watched them [Wall Street] get bailed out in 2008 and couldn’t do anything about it. This is for the history books that my kids and all of your future kids will read as well.”

As the underdogs took on large institutional investors, hedge funds lost billions of dollars in January alone, with Melvin Capital losing 53% in January 2021 (Reuters, 2021). This was also during a time when people were still reeling from the effects of the pandemic, where some members or their families had lost jobs, while others waited for a new stimulus check (Hadly, 2021). Although the stock market boomed, most investors barely saw those gains reflected in their financial situation. Frustrated at Wall Street again benefiting from policies and systemic affordances like a repeat of the recession in 2008, retail investors took it upon themselves to counter this imbalance and tipped the scales to their favor by using social media for tactical organization and shorted the stock en masse.

Miscellaneous

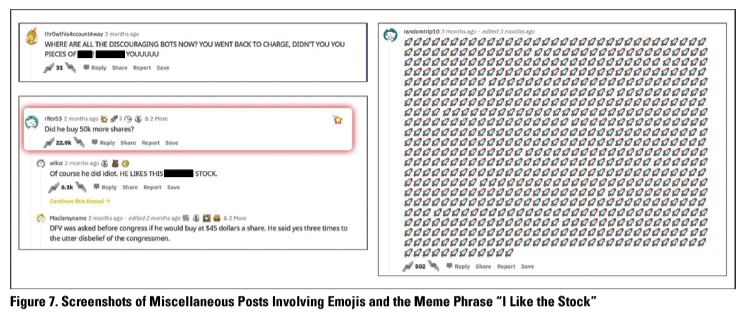

There were also many other posts which did not fit a specific category in our analysis, ranging from funny songs, memes, emojis, photos of tattoos, to posts by bots or paranoia about posts by bots distracting members with misinformation. There were also postings like “I like the stock,” something that retail investors said to show they were not selling the stock due to their love for the video game company, GME. When DFV used this phrase in the first live Congressional hearing, it was deemed a signal to his followers that he was still in the game and that he was a member of the community, thus further reinforcing his popularity (Figure 7).

As mentioned earlier, WSB members used insider language to communicate––a popular discourse strategy on other subreddits––that may seem confusing to others. Here are a few common terms used in the WSB subreddit and their meanings:

- Diamond Hands: When traders hold on to a stock instead of selling it, undeterred by rising or falling prices because they

believe in its future success, they are said to have diamond hands. It is denoted by the emojis of a diamond and two hands.

believe in its future success, they are said to have diamond hands. It is denoted by the emojis of a diamond and two hands. - Paper Hands: The opposite of diamond hands, traders have paper hands when they sell a stock at the slightest price rise for minimal profits, or when they do not trust the stock to do well and sell it to prevent losses. The emojis of a toilet paper roll and hands are used to denote this.

- Tendies: Tendies or chicken tendies mean profits made on an investment (Figure 8). They are denoted with the emoji of a fried chicken leg.

- To the moon: Used as a rallying cry by retail investors when they believe the price of stock or cryptocurrency will go up. Denoted by emojis of a rocket ship and the moon.

- YOLO: YOLO is an acronym for “you only live once,” and when you YOLO a stock, it means you have poured in a significant amount of your savings in a risky investment in anticipation of gains.

- Stonks: A misspelling of stocks, usually used when humorously referring to losses, accompanied by the stonk man meme

- Loss porn: When people post screenshots of their portfolio with massive losses

- HODL: Holding a stock, more commonly used in cryptocurrency investment

IMPLICATIONS FOR TECHNICAL COMMUNICATION

The WSB-GME frenzy is not just an isolated case of a group of investors getting lucky and making thousands to millions of dollars during the short squeeze period (Brown & McEvoy, 2021; Griffith, 2021). It also shows a growing trend of the democratization of financial information that is no longer restricted to a few big institutional investors and represents how social media are being organized for widespread networked communication, tactical organizing, and consumer engagement. From our case study, we have identified implications of the WSB-GME saga, many of which are unfolding as we write this article and as the GME stock price shows no sign of crashing back to pre-2021 levels.

On a more theoretical level, this case study revealed the mediating power of a social media platform in grassroots organizing, albeit for profit purposes, among non-experts. In situating the study, we asked, “What can the WSB-GME online frenzy teach us about tactical organizing?” We realized the rhetorical implication of this social phenomenon can be scrutinized through the complicated relationships between the social, the technical, the political, and the technological aspects of (technical) communication.

From examining the unfolding of the WSB-GME frenzy, we learned that tactical organizing requires an inherent social uptake. This uptake can be promoted by a digital platform that allows news sharing and user interactions. GME is one of many meme stocks, that is, stocks which see sudden surges in price due to viral social media activity in platforms like Reddit and Twitter. Other examples of meme stocks include Nokia, Blackberry, Bed Bath & Beyond, Koss Corporation, and companies like Tesla, which witnessed a short squeeze in 2020, surging 740% and short sellers losing $38 billion (Winck, 2020; Runkevicius, 2020). In the case of GME too, a public forum such as Reddit enabled such exchanges of information, but more importantly, it led to an emergence of influencers. These influencers were first self-established through the display of ethos but later gained a larger following through communal adoration. It seems that tactical organizing is also grounded in shared leadership (vertical and horizontal communities) in order to cultivate sharing of expertise and experience. Actors in tactical organizing participate in discourses that seek a common goal (i.e., democratizing financial information). In such discourses, information is socialized by the means of technical exchanges (how something works) and political expressions (how something should work) of the actors involved.

Human actors are not the only driver of tactical organizing. As explained by theories of tactical technical communication and posthumanism, technology also assumes an agentive role in facilitating tactical efforts. In this study, we analyzed the discourses of lay people on a social network and the analysis has led to observations about the influence of interactive features on the social platform on community organizing. While we have not quantified the correlations between the interactive features and discourse formation––as our study did not focus on analyzing Reddit as a system––we believe it is important to highlight here the role of algorithms in shaping online exchanges. To be exact, Reddit incentivized original content generation as well as reposts of existing contents. This social platform that resembles a bulletin board system allowed users to locate and follow the development of the WSB-GME saga while feeding featured posts by influencers to motivate user actions. The rating system on Reddit (upvotes and downvotes) creates ranked content that influences the visibility of an event such as the WSB-GME frenzy. As we have attempted to show in the screenshots of sample posts in the results section, certain users became influencers because their posts seemed to resonate with other users, thus elevating them to the top of a thread. Whether they were keywords (e.g., “I like this stock”) or emojis, Reddit and its users co-promote relevant content by featuring them visually and prominently. Together, these technological features worked as co-actors that affect the outcomes of a tactically organized event. For technical communication scholars, this event is a telling example for the continued advancement of tactical technical communication theories and approaches.

The second question we asked in this study was, “What can the WSB-GME online social mania teach us about tactical technical communication?” The themes that emerged from our critical discourse analysis reveal a systematic and surprisingly sentimental interaction taking place on a digital forum, and this has multiple practical implications in terms of social media use and networked interactions, distributed knowledge management, and community-driven movements.

Our study calls attention to the function of rhetoric and influences of both casual and savvy players of the stock market––a space that has evidently become more fragmented and shaped by online discourses and communities. The vertical and horizontal interactions that were taking place between major players like DFV and WSB subscribers show a sense of community that goes beyond just a transactional relationship that one usually associates with stock market activities. Wall Street has often come under attack for not reflecting the actual state of the economy, where previous movements like Occupy Wall Street have attacked the excesses of institutional investor greed and ruthlessness. However, in the GME-WSB saga of 2021, we see a shift from an outrage and demand for reformation of Wall Street to the emergence of retail investors gaming the system to their advantage by embracing their collective power afforded by social media platforms. We find that these investors have a sentimental connection with GME, a video game retailer that they associate with their childhood memories. We note similar sentiments towards other companies which followed GME, the most prominent being the movie theater company, AMC. Short sellers had betted against these companies, essentially hoping that they would go bankrupt, and retail investors took it upon themselves to prevent that from happening, and also pocketed the gains that came along in the process.

We also notice people from non-finance professions like teachers, plumbers, construction workers, students, single parents working two to three jobs, or someone saving money to buy a house for their parents, and so forth, investing just a few hundred dollars and hoping for a better life. This creates a community driven by empathy and solidarity, where everyone roots for the underdogs. It is not surprising to see people posting pictures of their contributions to local non-profit organizations and giving back to the community in real life. However, meme stock investing in low to no fee brokerage apps is not as regulated as traditional stock market transactions, and thus can be very risky. There are multiple instances of inexperienced investors getting caught up in the social media frenzy and failing to time the market and the short squeeze, leading to massive losses, too (Phillips et al., 2021). This has led the SEC and various Congressional Committees to mull over whether it should be mandatory for online brokerages to clearly communicate with traders about the risks of buying such stocks, before the trade is completed (Gasparino & Terrett, 2021).

Since our article presents a snapshot of the GME frenzy, we did not find any particularly dissenting comments among the top posts that we studied during the January and February 2021 period. However, one reason for this could be that dissenting posts were deleted, such as the ones by some moderators of the subreddit who were banned due to clashes with other moderators over a movie deal and the future of the group (Asarch, 2021). In another instance, WSB members who had set up a group on Discord also called r/wallstreetbets, were accused of violating Discord’s policies on hate speech, which led to the platform banning the group (Sonnemaker, 2021).

Nevertheless, the WSB subreddit created a space for retail investors to express themselves, build community, support each other, and make profits through the mass buying and holding of GME stocks leading to a short squeeze. What GME, WSB, and DFV started can now be seen in other platforms too, such as TikTok, FinTwit (financial Twitter), Discord, Twitch, and YouTube. And there are personalities like Trey from Trey’s Trades, who informs people about AMC, and other big names like Elon Musk, regarded as the “Dogefather” of the cryptocurrency, Dogecoin. Musk discussed Dogecoin on an episode of Saturday Night Live.

The GME saga has also changed how other companies communicate with their shareholders. Taking their cue from the impact WSB’s retail investors have on prices of meme stocks, AMC CEO Adam Aron gave multiple interviews to Trey live on YouTube, where he discussed the importance of redefining consumer engagement and financial communication. In June, Aron revealed that 80% of AMC shares are held by retail investors with an average holding of 120 shares (Goldsmith, 2021); Aron also announced Investor Connect initiative, which will allow the company to directly communicate with its “extraordinary base of enthusiastic and passionate individual shareholders,” to keep them informed about company plans and provide them with special offers (Kilgore, 2021).

For scholars, teachers, and researchers, this case study provides yet another story of how rhetoric can be operationalized beyond the classroom and into the social world. Our engagement with economics, autonomy, and public movements aimed to demonstrate how online discourses and platforms can be weaponized for utilitarian purposes. For students of technical communication, we hope that this case study demystifies “grown-up” spaces like the stock market, which most non-financial experts may find intimidating. Pedagogically speaking, this study contributes to social justice-oriented conversations about class and capital via a digital platform that most students are aware of (i.e., Reddit, as well as the familiar influencer culture online). We hope this study opens a gateway toward other relevant discussions and investigations focused on participatory action and tactical democratization of activities like finance to broaden the scope of inquiry in technical communication.

CONCLUSION

Tactical organizing in online spaces encompasses a complex convergence of social uptake and socialized information afforded by news sharing and mass user interactions on digital platforms like Reddit. It is driven by a discourse founded on a shared common goal and a shared leadership that emerges from vertical and horizontal community building. While technology assumes an agentive role in facilitating tactical efforts, it can also create an information bubble, where users may be gripped by a cult-like devotion for their heroes and desire to be part of the latest trends, thereby making risky financial bets. The WSB-GME saga illustrated real-world implications of tactical technical communication theories as well as the impact of networked interactions on democratization of information, consumer engagement, and the rhetoric of finance. The WSB-GME event is still developing as we write, and although the stock price has fallen from its peak in January 2021, it is still up 823.48% year-to-date (Google Finance, 2021). As retail investors remain enthusiastic about the stock while also branching out to other companies, it will be important to consider future implications of such organizing on other platforms and its impact on tactical technical communication.

REFERENCES

Agboka, G. Y. (2013). Participatory localization: A social justice approach to navigating unenfranchised/disenfranchised cultural sites. Technical Communication Quarterly, 22(1), 28–49.

Asarch, S. (2021, February 7). Reddit banned a group of Wallstreetbets moderators after they staged an attempted coup. Insider. https://www.insider.com/wallstreetbets-reddit-bans-moderators-gamestop-started-movie-deal-coup-2021-2

Bentz, A. (2021, February 1). Netflix’s GameStop movie: Noah Centineo cast. ScreenRant. https://screenrant.com/gamestop-stock-movie-netflix-noah-centineo-cast/

Boyle, C. (2018). Rhetoric as a posthuman practice. Columbus, OH: The Ohio State University Press.

Brown, A., & McEvoy, J. (2021, February 12). The new GameStop millionaires: Meet the amateur traders who won investing’s craziest sweepstakes ever. Forbes. https://www.forbes.com/sites/abrambrown/2021/02/12/the-new-gamestop-millionaires-meet-the-amateur-traders-who-won-investings-craziest-sweepstakes-ever/?sh=12c8a13a47f5

Buchanan, I. (2010). A dictionary of critical theory. New York, NY: Oxford University Press. Retrieved from https://www.oxfordreference.com/view/10.1093/oi/authority.20110803100339501

Business Insider. (2021). Tesla short-sellers lost $38 billion throughout the Automaker’s colossal 2020 rally. Business Insider. https://markets.businessinsider.com/news/stocks/tesla-stock-short-sellers-lost-billions-rally-elon-musk-tsla-2021-1

Colton, J. S., & Holmes, S. (2016). A social justice theory of active equality for technical communication. Journal of Technical Writing and Communication, 48(1), 4–30.

Colton, J. S., Holmes, S., & Walwema, J. (2017). From NoobGuides to #OpKKK: Ethics of anonymous’ tactical technical communication. Technical Communication Quarterly, 26(1), 59–75.

Cummings, S. (2002). Community economic development as progressive politics: Toward a grassroots movement for economic justice. UCLA: School of Law. Retrieved from https://escholarship.org/uc/item/19d6z0dc

Dumitrica, D. & Felt, M. (2020). Mediated grassroots collective action: Negotiating barriers of digital activism. Information, Communication & Society, 23(13), 1821–1837.

Forgey, M. (2015). Defining the 99%: A rhetorical critique of the Occupy Wall Street movement. [Doctoral dissertation]. University of Nevada, Las Vegas. Retrieved from https://digitalscholarship.unlv.edu/cgi/viewcontent.cgi?article=3474&

context=thesesdissertations

Gage, J. (2019, March 14). Yang gang: The memes powering one longshot democrat’s unlikely ascent to the debate stage. Washington Examiner. https://www.washingtonexaminer.com/news/yang-gang-the-memes-powering-one-longshot-democrats-unlikely-ascent-to-the-debate-stage

Gasparino, C., & Terrett, E. (2021, June 7). SEC mulls GameStop, AMC ‘gamification’ crackdown with regulatory layer. Fox Business. https://www.foxbusiness.com/markets/sec-gamestop-amc-stock-gamification-crackdown-regulatory

Getto, G., Franklin, N., & Ruszkiewicz, S. (2014). Networked rhetoric: iFixit and the social impact of knowledge work. Technical Communication, 61(3), 185–201.

Goldsmith, J. (2021, June 9). AMC Entertainment says its 4.1 million individual investors own 80% of stock, average 120 shares each. Yahoo! https://www.yahoo.com/now/amc-entertainment-says-4-1-210729566.html?guccounter=1&guce_referrer=aHR0cHM6Ly93d3cuZ29vZ2xlLmNvbS

8&guce_referrer_sig=AQAAAKPP2wJ5EYYK7beC2YVlNkZE72vSAnEgD7udfWqaw8ffIgdR2X6h3xRBLBWqmq-zBBFCycBpXSHKjzm6jU2VWApUMlEeUvu5g1KMokHNcZDVuA42R57dIi3pijRi2k8UCkkCWEupxwh5sGbXwzv8lkum48IbwExO3bTiisqkRh1D

Google Finance. (n.d.). GameStop Corp. (GME: NYSE) stock price & news. Google Finance. https://www.google.com/finance/quote/GME:NYSE?sa=X&ved=2ahUKEwiG9vjR78XyAhWFVc0KHWXnCVkQ3ecFMAJ6BAgrEBI&window=YTD

Griffith, K. (2021, January 28). GameStop’s three largest shareholders have gotten $3 billion richer in two weeks. Daily Mail Online. https://www.dailymail.co.uk/news/article-9193697/GameStops-three-largest-shareholders-gotten-3BILLION-richer-two-weeks.html

Hadly, C. (2021, February 4). WallStreetBets is America. Vox. https://www.vox.com/the-goods/22264303/wallstreetbets-reddit-gamestop-stocks-language-community

Handagama, S. (2021, January 29). Small investors worldwide jump into the GameStop frenzy. CoinDesk. https://www.coindesk.com/all-over-the-world-small-investors-jump-into-the-gamestop-frenzy

Hinchcliffe, D. (2020, Sept). Why community belongs at the center of today’s remote work strategies. On Digital Strategy. Retrieved from https://dionhinchcliffe.com/2020/09/23/why-community-belongs-at-the-center-of-todays-remote-work-strategies/

Huckin, T., Andrus, J., & Clary-Lemon, J. (2012). Critical discourse analysis and rhetoric and composition. College Composition and Communication, 64(1), 107–129.

Jones, J. (2014). Compensatory division in the Occupy movement. Rhetoric Review, 33(2), 148–164.

Jones, N. N., Moore, K. R., & Walton, R. (2016). Disrupting the past to disrupt the future: An antenarrative of technical communication. Technical Communication Quarterly, 25(4), 211–229.

Kilgore, T. (2021, June 2). AMC offers new perks for retail investors: Free large popcorn. MarketWatch. https://www.marketwatch.com/story/amc-entertainment-unveils-amc-investor-connect-offering-retail-shareholders-free-popcorn-11622634109

Kimball, M. (2006). Cars, culture, and tactical technical communication. Technical Communication Quarterly, 15(1), 67–86.

Kimball, M. (2017). Tactical technical communication. Technical Communication Quarterly, 26(1), 1–7.

Li, Y. (2021, January 29). GameStop short sellers are still not surrendering despite nearly $20 billion in losses this month. CNBC. https://www.cnbc.com/2021/01/29/gamestop-short-sellers-are-still-not-surrendering-despite-nearly-20-billion-in-losses-this-year.html

Lockett, A. (2021). What is Black Twitter? A rhetorical criticism of race, dis/information, and social media. In A.L. Lockett, I.D. Ruiz, J.C. Sanchez, and C. Carter (Eds.), Race, rhetoric, and research methods (pp. 165–213). Fort Collins, CO/Boulder, CO: The WAC Clearinghouse/University Press of Colorado.

MacDonald, M. (2011). Martial McLuhan I: Framing information warfare. Enculturation: A Journal of Rhetoric, Writing, and Culture. Retrieved from http://enculturation.net/martial-mcluhan

Mara, A. & Hawk, B. (2009). Posthuman rhetorics and technical communication. Technical Communication Quarterly, 19(1), 1–10.

Martineau, P. (2017, December 19). The storm is the new pizzagate – only worse. Intelligencer. https://nymag.com/intelligencer/2017/12/qanon-4chan-the-storm-conspiracy-explained.html

Massanari. (2017). Gamergate and The Fappening: How Reddit’s algorithm, governance, and culture support toxic technocultures. New Media & Society, 19(3), 329–346. https://doi.org/10.1177/1461444815608807

McCluskey, M. (2021, June 24). How finance TikTok is navigating ‘meme stock’ hype. Time. https://time.com/6073524/meme-stock-tiktok/

McLuhan, M. (1964). Understanding media: The extensions of man. Cambridge, MA: The MIT Press.

McNely, B. (2017). Moments and metagenres: Coordinating complex, multigenre narratives. Journal of Business and Technical Communication, 31(4), 443–480.

Metrics for Reddit. (2021, April 2). /r/wallstreetbets metrics (wallstreetbets). Metrics for Reddit. Retrieved April 2, 2021, from https://frontpagemetrics.com/r/wallstreetbets

Nann, S. (2019, October 14). How does social media influence financial markets? Nasdaq. https://www.nasdaq.com/articles/how-does-social-media-influence-financial-markets-2019-10-14

Phillips, M., & Lorenz, T. (2021, January 27). ‘Dumb money’ is on GameStop, and it’s beating wall street at its own game. The New York Times. Retrieved April 02, 2021, from https://www.nytimes.com/2021/01/27/business/gamestop-wall-street-bets.html

Phillips, M., Lorenz, T., Bernard, T. S., & Friedman, G. (2021, February 7). The hopes that rose and fell with GameStop. The New York Times. https://www.nytimes.com/2021/02/07/business/gamestop-stock-losses.html

Pigg, S. (2014). Coordinating constant invention: Social media’s role in distributed work. Technical Communication Quarterly, 23(2), 69–87.

Potts, L. (2014). Social media in disaster response: How experience architects can build for participation. New York, NY: Routledge.

Potts, L., Small, R., & Trice, M. (2019). Boycotting the knowledge makers: How Reddit demonstrates the rise of media blacklists and source rejection in online communities. IEEE Transactions on Professional Communication, 62(4), 351–363.

Rashid, Y., Rashid, A., Akid Warraich, M., Sameen Sabir, S., & Waseem, A. (2019). Case study method: A step-by-step guide for business researchers. International Journal of Qualitative Methods, 18, 1–13.

Rice, J. (2016). Digital outragicity. Enculturation: A journal of rhetoric, writing, and culture. Retrieved from http://enculturation.net/digital_outragicity

Ridolfo, J., & Hart-Davidson, W. (Eds.) (2019). Rhet ops: Rhetoric and information warfare. Pittsburgh, PA: University of Pittsburgh Press.

Runkevicius, D. (2020, August 18). Tesla stock may be rallying for this absurd reason-and this won’t end well. Forbes. https://www.forbes.com/sites/danrunkevicius/2020/07/20/tesla-stock-may-be-rallying-for-this-absurd-reasonand-this-wont-end-well/?sh=c5a398567a66

Sano-Franchini, J. (2018). Designing outrage, programming discord: A critical interface analysis of Facebook as a campaign technology. Technical Communication, 65(4), 387–410.

Sarat-St. Peter, H., & Kimball, M. (2020). Call for abstracts: Tactical approaches to technical communication. Retrieved from https://docs.google.com/document/d/1cq13bd3PvM6jf2oafne4k2kuW1lAfwIY_SI30syr2iU/edit

Shepard, R. P. (2020). What Reddit has to teach us about discourse communities. Kairos: A Journal of Rhetoric, Technology, and Pedagogy, 24(2). Retrieved from http://kairos.technorhetoric.net/24.2/praxis/shepherd/index.html

Shivers-McNair, A., & San Diego, C. (2017). Localizing communities, goals, communication, and inclusion: A collaborative approach. Technical Communication, 64(2), 97–112.

Sonnemaker, T. (2021, January 27). Discord bans R/wallstreetbets server over hate speech as the group drives GameStop shares through the roof. Business Insider. https://www.businessinsider.com/discord-bans-wallstreetbets-server-hate-speech-reddit-gamestop-gme-2021-1

Stephen, B. (2018, June 26). The gospel of Elon Musk, according to his flock. The Verge. https://www.theverge.com/2018/6/26/17505744/elon-musk-fans-tesla-spacex-fandom

Stocks Plunge, with Dow in Bear Market. (2020, March 11). The New York Times. Retrieved April 02, 2021, from https://www.nytimes.com/2020/03/11/business/stock-market-today.html

This Rhetorical Life. (2013, Mar 15). Episode 5: The rhetoric of Occupy Wall Street with Dennis Trainor Jr [Audio podcast]. Retrieved from https://thisrhetoricallife.syr.edu/tag/occupy/

Thomson Reuters. (2021, April 9). Hedge fund Melvin Capital lost 49% on its investments in Q1 -source. Reuters. https://www.reuters.com/lifestyle/wealth/hedge-fund-melvin-capital-lost-49-its-investments-q1-source-2021-04-09/

Truscello, M. (2005). The rhetorical ecology of the technical effect. Technical Communication Quarterly, 14(3), 345–351.

Tufekci, Z. (2013). “Not this one”: Social movements, the attention economy, and microcelebrity networked activism. American Behavioral Scientist, 53(7), 848–870.

Vlessing, E. (2021, February 4). WallStreetBets founder sells life rights to RatPac Entertainment. The Hollywood Reporter. https://www.hollywoodreporter.com/movies/movie-news/wallstreetbets-founder-sells-life-rights-to-ratpac-entertainment-4127759/

Walls, D. W. & Vie, S. (Eds.) (2017). Social writing/social media: Publics, presentations, and pedagogies. Fort Collins, CO: WAC Clearinghouse.

Walton, R., Moore, K., & Jones, N. (2019). Technical communication after the social justice turn: Building coalitions for action. New York, NY: Routledge.

WHO (2020, March 11) Director-general’s opening remarks at the media briefing on Covid-19. Retrieved April 02, 2021, from https://www.who.int/director-general/speeches/detail/who-director-general-s-opening-remarks-at-the-media-briefing-on-covid-19—11-march-2020

Winck, B. (2021, January 1). Tesla short-sellers lost $38 billion throughout the automaker’s colossal 2020 rally. Business Insider. https://markets.businessinsider.com/news/stocks/tesla-stock-short-sellers-lost-billions-rally-elon-musk-tsla-2021-1

Wolff-Mann, E. (2021, February 9). 28% of Americans bought GameStop or other viral stocks in January: Yahoo Finance-Harris poll. Yahoo! Finance. https://finance.yahoo.com/news/gamestop-amc-reddit-investing-213609595.html

Yahoo Finance (2022, March 8). GameStop Corp.(GME) stock historical prices & data. Yahoo! Finance. Retrieved March 8, 2022, from https://finance.yahoo.com/quote/GME/history?period1=1583539200&period2=1586217600&interval=1d&filter=history&frequency=1d&includeAdjustedClose=true

Yin, R. K. (2002). Case study research: Design and methods. Sage.

Yin, R. K. (2011). Applications of case study research. Sage.

Yin, R. K. (2017). Case study research and applications: Design and methods. Sage.

ABOUT THE AUTHORS

Meghalee Das is a PhD candidate in technical communication and rhetoric at Texas Tech University, and the president of the local STC student chapter. She teaches first-year composition and technical writing courses and is an assistant director of the first-year writing program. Her research interests include user experience, cultural inclusivity, online pedagogy, and digital rhetoric, and her articles have appeared in Intercom. She may be reached at Meghalee.Das@ttu.edu.

Jason Tham is an assistant professor of technical communication and rhetoric in the Department of English at Texas Tech University. He teaches user experience (UX) research, information design, and digital rhetoric. He is faculty sponsor to the local STC Student Chapter and co-director of the UX Research Lab. His recent scholarship includes Design Thinking in Technical Communication (2021, Routledge) and Collaborative Writing Playbook (2021, Parlor Press, with Joe Moses). He may be reached at jason.tham@ttu.edu.